Ultimate Overview to Recognizing Corporate Volunteer Agreements and Exactly How They Benefit Businesses

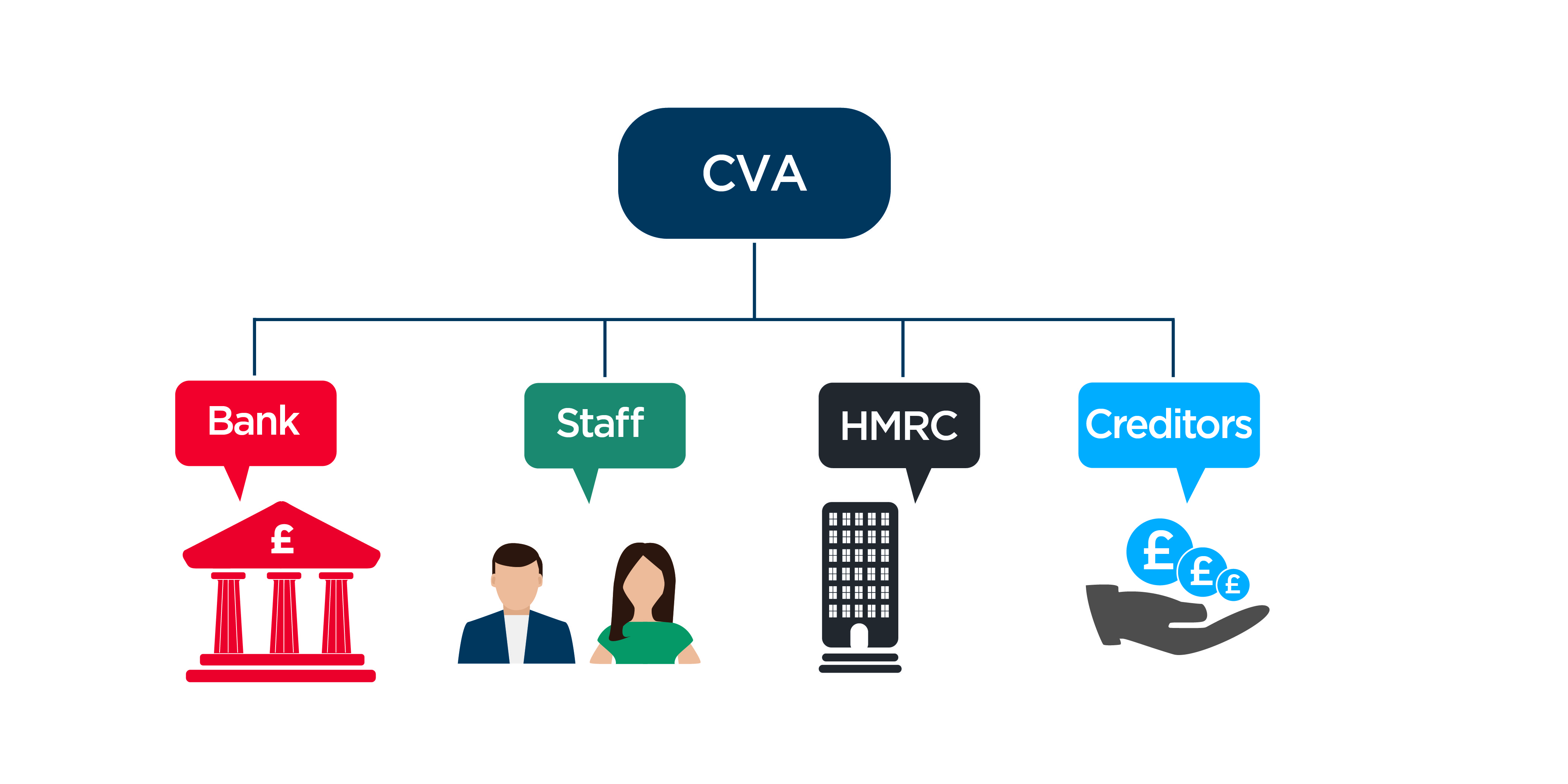

Business Voluntary Arrangements (CVAs) have actually become a calculated tool for businesses wanting to browse monetary difficulties and restructure their operations. As the organization landscape remains to advance, recognizing the details of CVAs and just how they can positively impact companies is crucial for educated decision-making. From providing a lifeline to having a hard time organizations to fostering a path in the direction of sustainable development, the advantages of CVAs are multifaceted and customized to resolve a variety of business demands. In this guide, we will certainly check out the subtleties of CVAs, clarifying their advantages and the process of implementation, while additionally delving into key considerations that can make a considerable distinction in a company's monetary health and future leads.

Recognizing Corporate Volunteer Agreements

In the realm of corporate governance, an essential principle that plays an essential role fit the partnership in between stakeholders and business is the elaborate mechanism of Corporate Voluntary Arrangements. These arrangements are volunteer dedications made by firms to comply with specific standards, practices, or goals beyond what is lawfully required. By getting in into Corporate Volunteer Arrangements, firms show their commitment to social responsibility, sustainability, and ethical organization methods.

One key aspect of Business Voluntary Contracts is that they are not lawfully binding, unlike regulatory needs. Companies that willingly devote to these agreements are still expected to support their guarantees, as failing to do so can result in reputational damage and loss of stakeholder depend on. These contracts frequently cover areas such as ecological security, labor civil liberties, variety and incorporation, and community involvement.

Benefits of Company Voluntary Arrangements

Relocating from an exploration of Company Volunteer Agreements' value, we currently transform our interest to the concrete benefits these agreements use to business and their stakeholders. Among the key advantages of Corporate Voluntary Contracts is the possibility for companies to restructure their financial debts in a more manageable way. This can help minimize financial problems and avoid prospective bankruptcy, permitting the service to continue running and potentially grow. Furthermore, these agreements supply an organized framework for arrangements with lenders, promoting open communication and collaboration to reach mutually beneficial options.

Moreover, Business Voluntary Contracts can boost the company's online reputation and partnerships with stakeholders by demonstrating a dedication to resolving financial challenges responsibly. Generally, Business Voluntary Contracts offer as a strategic device for business to navigate economic hurdles while maintaining their connections and operations.

Process of Implementing CVAs

Recognizing the procedure of applying Company Voluntary Contracts is important for firms seeking to navigate economic obstacles successfully and sustainably. The initial action in applying a CVA includes selecting a certified insolvency professional that will certainly function very closely with the business to examine its financial situation and stability. Throughout the implementation process, regular interaction with financial institutions and attentive financial management are key to the successful implementation of additional hints the CVA and the business's eventual economic recuperation.

Secret Factors To Consider for Organizations

An additional important factor to consider is the level of openness and interaction throughout the CVA procedure. Open and truthful communication with all stakeholders is crucial for constructing trust fund and making sure a smooth application of the contract. Companies should likewise think about seeking specialist advice from economic experts or legal specialists to navigate the complexities of the CVA process efficiently.

In addition, companies require to assess the long-lasting effects of the CVA on their credibility and future funding possibilities. While a CVA can provide immediate relief, it is vital to assess just how it may affect connections helpful resources with creditors and investors in the lengthy run. By carefully thinking about these crucial factors, businesses can make informed decisions relating to Business Volunteer Agreements and establish themselves up for an effective financial turnaround.

Success Stories of CVAs at work

A number of organizations have efficiently executed Business Volunteer Contracts, showcasing the performance of this monetary restructuring device in revitalizing their procedures. One notable success story is that of Business X, a battling retail chain encountering bankruptcy due to installing financial obligations and declining sales. By becoming part of a CVA, Firm X was able to renegotiate lease contracts with landlords, decrease overhead costs, and restructure its debt obligations. Because of this, the company was able to maintain its economic setting, improve cash flow, and prevent bankruptcy.

In another instance, Company Y, a production firm burdened with tradition pension obligations, utilized a CVA to rearrange its pension plan obligations and simplify its procedures. Through the CVA process, Company Y accomplished substantial cost financial savings, boosted its competition, and secured lasting sustainability.

These success stories highlight just how Corporate Voluntary Contracts can give struggling companies with a practical course in the direction of monetary recuperation and operational turn-around. By proactively resolving economic difficulties and reorganizing responsibilities, firms can emerge stronger, more dexterous, and better positioned for future development.

Final Thought

In conclusion, Company Voluntary Agreements provide businesses a structured strategy to solving monetary problems and restructuring debts. By applying CVAs, companies can stay clear of bankruptcy, protect their assets, and preserve connections with lenders.

In the world of business administration, a fundamental principle that plays a crucial role in forming the connection between stakeholders and business is the detailed device of Corporate Voluntary Agreements. corporate voluntary agreement. By entering right into Business Volunteer Arrangements, firms demonstrate their dedication to social responsibility, sustainability, and moral organization methods

Moving from an expedition of Corporate Volunteer Arrangements' importance, we currently transform our focus to the tangible benefits these arrangements provide to companies and click for source their stakeholders.Additionally, Company Volunteer Arrangements can improve the firm's reputation and partnerships with stakeholders by demonstrating a dedication to attending to financial difficulties responsibly.Comprehending the process of applying Business Volunteer Arrangements is necessary for business seeking to browse economic obstacles properly and sustainably.